Not much exciting news on the twitter front for me, had a pretty busy week. Going to fire off the auto-includes: @marshallLRcast and @modogodot from Limited Resource Podcast over at MTGcast.com.

I will note that i got a new follower today, @EWDraftCast who is apparently a competitor to LR, i'll certainly check them out. (also on MTGcast.com) I dont expect them to eclipse LR, but maybe a good supplement to my weekly content consumption.

Also, a big #FF to @dtlerch and @chosler88, both QuietSpeculation.com writers {*cough* did you read my latest at QuietSpeculation Insider, yet?} They are also both headed to GP Dallas this weekend, and @dtlerch is running a slightly modified version of my Pyromancer brew. I know Corbin is/was considering it, but i think he went with a safer play (can't blame him). DO WORK! Thanks for the ManaScrewed plug, Corbin!

Other people I'm happy I follow:

@wrongwaygoback

@samstod

@kstube@cavemankellen

@smi77y

@manadeprived

@steve032

@alawley

@two_eyes

@hobbesq

@thebrandondrury

@stillhadthese

@ejsetzer

@affinityforblue

there's more, but those are a bunch of them, some of which i hadn't shown any #ff love for awhile, so i hope you go follow any of them you aren't already. really good stuff, all around.

Today, I am going to briefly

So, where to begin? I've trolled @joshjmtg a bit about his #savelegacy campaign, but at least I can understand why he feels the way he does, and why he's pushing for what he wants. He wants wizards to reprint staples, to bring prices down, and increase availability for cards. His reasoning, from what I understand, is that SCG will stop holding events for Legacy, if they aren't able to hold a stock to sell Legacy singles at the events, this would in turn create a crash in the Legacy market, and put Legacy back into the "fringe" areas of competetive play. I have two issues with his claims, but I'll only spend brief time on them, because at least he has a valid concern. First, WotC has no need to do this, they are already peaking with their current marketing strategy, and making changes to that may please some people, but there's simply no incentive for them to repring said staples. Some would argue that it helps sell existing sets, but they aren't exactly having a problem with that, lately. Same goes with From the Vaults, and other special offerings. Second, if SCG is holding huge cash tournaments every weekend, and the market can't withstand the demand for the cards, then it simply wasn't meant to be. Not that I'd be happy to see Legacy fade into the background again, but it's just the way it is. I applaud him for being passionate about something he feels strongly about, but really, there's no big deal here. It's not like Legacy didn't exist before, it still will be around, there will still be cash tournaments, just not as frequent.

I thought this would be the end of my tirade on Legacy, but sadly, no, I was unable to stay away from the shitstorm that occured earlier this week over on Mananation. I really hate to provide any incentive to drive more traffic to their site, as unwarranted bashing has turned into a marketing scheme, but you can find the article here. I commented extensively in the comments section, as did many others, but due to time constraints, i really wasn't able to give the topic my full attention, and per special request to @marshallLRcast I've decided to do my best to point out the serious flaws in this article.

I should start by saying, that Sean Morgan, the author of said article, is an educator with a Masters in a relevant field. Unfortunately (and not all that uncommon), he chose to hide his loosely veiled liable behind some actual (academic) economic terms. This caused some people to rally behind him, praising his wealth of knowledge. Meanwhile, Ben Bleiwiess, the subject of the article, chimed in to refute many of Seans claims. Which Ben did with perfect (n)ettiquette and did so in a very complete manner. Most of my feelings about the subject mirror Ben's. So again, I'll be brief on this, as my real axe to grind is an issue parallel to this.

- Starcitygames.com (SCG) obtains no benefit from artificially raising the price on Legacy staples they do not have currently in stock. The common argument is that SCG is trying to corner the market by buying up all the cards, and capitalizing on inflated prices quickly before they drop again. This is near impossible. Not only do competing sites ALSO jack up their buy prices, but prices also climb on EBay and Local Gaming Stores(LGS) around the globe. SCG is not at any advantage to these other sites, as far as their ability to buy cards at higher prices goes. Second, raising the price as they buy, is only going to have a negligible effect on their profit per card. Buying a Force of Will for $30 to flip and sell for $50, makes the same profit as buying for $40 and selling for $60. If they had an absurd amount of units on hand already, then perhaps price-gouging could be claimed, but they don't. If they did, they wouldn't need to jack up their buy prices so quickly. In Ben's (paraphrased) words, "We bought 50 Force of Wills since last week, and now there's only 3 left." The cards are flying off their shelves, and they simply have to raise their buy prices to maintain a stock to offer their customers at their events.

- There is a fixed quantity of Legacy staples in the marketplace, and as demand increases, there is an exponential effect on pricing, because the dealers are forced to increase buy prices simply to keep units in stock. Even if speculators are driving prices higher than actual demand (which is unprovable, and has a minor effect if any) the pricing will normalize to an equilibrium price. When buy prices go higher, people who once didn't want to sell their cards, may suddenly decide to do so. Eventually, there will be a flood of people dumping cards, and the price will come back down until there's a nice balance again. This is the way a competetive market works. There's no government regulation or interference in this market, and no 3rd parties driving market movement for derivative gains (mortgage market).

So, that's that. But why do i have a pinecone up my ass over his misrepresentation of the situation to his audience? Because he's attempting to use academic economics to back up his claims, and he's doing so in a fallacious manner. Usually, what this means, is people who aren't educated on the topic assume the guy with the Masters degree is right, and jump on board. I'm quite sure this is the effect he was going for. He draws parallels to "every major market bubble in the past century". No one balked at this but me. Seriously dude? You're trying to tell me that the housing bubble has parralels to this? Not a chance. The housing bubble was created by the banks, who had the ability to offer "amazing" (See: misleading) loans to unqualified buyers. Mortgage offices were bombarded my smokin-hot account executives who pushed cleavage in the face of Mortgage Brokers to sell these products (that were not a good fit for the buyers, but sounded good at first) at high commissions. This caused way more people to go out and buy homes, than could afford them, driving the prices higher. As more and more people started defaulting on these loans, credit became tighter, no one could qualify to buy homes, and prices plummeted. Not to mention, these mortgages were packaged up as investments and sold to the everyday investor. Mortgages the banks KNEW had high risk of default (which is why they are called sub-prime loans, and now basically don't exist). Government stepped in, and now our economy has been faultering for years, but hey, i can totally see the parallels to Legacy Magic cards. The Mortgage crisis was started by the banks (and the Fed for allowing it) by pushing products that affected the housing market, that they knew would have a high rate of defaulted loans. Sean's argument, is that SCG opens are like the mortgage brokers here, pushing the prices of cards up. This part is true, but SCG is not in a position to gain from said price increases, they do however gain from more people attending their events, which would actually be incentive to keep prices lower. Their margin on a card is set to a pretty standard % of their buy price, and the actual price they buy/sell at is not extremely indicitave of what type of profits they are bringing in. They make money off of volume...

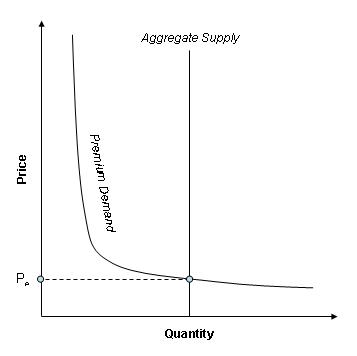

This is what a fixed supply (vertical line) looks like. You can see, as demand (the curved line, representing consumer's willingness to pay) shifts to the right (this means an increase in the quantity demanded at a given price, and/or a willingness to pay more for the same quantity) there is a gradual increase in price. Where the two lines intersect (shown with the dotted horizontal line) is the equilibrium price, where there is an equal number of people who want to buy and sell at that price. You can put your left hand up to that curved line in the shape of an L, and slide your hand to the right. The intersection point (where your thumb crosses the vertical line) is the price of the product, and it slowly increases, until you hit the corner where your thumb meets your hand. There is a scarcity of the good, and prices start to jump up rapidly for very small changes (shifts L->R of your hand) in demand. There is no bubble here. In reality, the demand (your Left hand) moved all at once and SCG (and other vendors) don't know how far it moved until they reach a buy price that people are finally willing to start dumping their goods to them. It starts out with a gradual change, but SCG has events every weekend and needs to fill their inventory, so they are aggressively seeking that equilibrium price. "But Chad, you said they make money on volume, what does that have to do with anything?" Good question, when prices increase more people are willing to part with their cards and sell them to dealers who can flip for a profit. When prices decrease, SCG gets to buy cards on the cheap from the people who are scared prices will continue to decline, and their sales volume increases as more people want to buy at the lower price. This is the basis for his claim that SCG is artificially moving prices, but is so far from the truth. It's only possible for them to actually gain money when they are moving units AS THE PRICES ARE MOVING. But as of now, all the items on their "Hot Buys" list that are moving the fastest, have 0 units in stock. Even if Sean claims that they are sandbagging these units to sell at a later date, they are missing out on the most opportune time to move these cards, PRICES ARE AT RECORD HIGHS.

The "bubble" that Sean is predicting, is only an actuality if SCG stops offering their events AND no other company steps in to replace them. Then the desire to hold these valuable cards, without the opportunity to use them in sanctioned play will fall off to a certain group of players, and the Demand will shift back to the left. You could consider this a "bubble bursting" if you wanted, but really its an external factor affecting the market, not the playability of the format or the cards. It's the incentive to play legacy is higher, and if that subsides, then yes the prices will too. That's what an equilibrium is, its a balance between buyers and sellers, and everytime a price corrects downward to meet that equilibrium point, there will always be someone claiming that there is a "bubble bursting" or that the "herd mentality" forced buying upward, but in fact it was an increase in ACTUAL demand in active legacy players. Period. I honestly can't understand how an educated Economist would make such claims with a straight face.

In summary, should the demand get so high that retailers literally can't hold any stock, then yes, SCG may stop offering Legacy events (i'd contend they'd continue holding them as an opportunity to buy stock) which would bring prices back down, but there just simply can't be a bubble here. Magic has a pretty open marketplace that heavily depends on AUCTIONS (ebay) to determine pricepoints. Auctions do a great job of depicting true willingness to pay, and real market price.

I hope this wasn't a boring lesson, but it really gets my goat when someone makes a bold claim, and backs it up with economic terms that are very incorrectly applied. A) he's bashing a company like SCG who is doing a great service to the community by putting on the events, and B) he's misusing economics to drive a madhouse of people to rally behind him, that are "homers" because they follow his article, or they read his side first, or it just seems cool to bash SCG.

For the record, I am not in anyway affiliated with Starcitygames.com

Thanks for reading! Have a great weekend.

To the discussion of bubbles I would also add that the housing bubble was only able to exist because of the ridiculously low price of capital fueled by significantly low interest rates in the US following the tech recession of 2001 and $1 trillion in yen currency carry trades until 2007, for neither of which any parallel exists in Magic.

ReplyDeleteI'd also seriously question the intellectual integrity of straight-up paralleling a secondary market arbitrageur (which is essentially what SCG is in the Legacy singles market, since their retail advantage in getting sealed product wholesale doesn't exist for out-of-print cards) to major investment banks pushing S&L institutions to make loans so that they can buy the loans and sell CDOs and other wacky securities, but hey, what do I know, I'm just an undergraduate. He has a Masters!

Yeah, its clear your understanding of what's going on here, is pretty complete. There's a whole gamut of things that happen in the housing market that don't happen in Magic cards, and just stating, "It's just like the housing bubble, here's some latin phrases that are relevant to Economics" doesn't make it correct. I tried to keep it as "leyman" as possible, but i know magic players are smart people, so i tried to balance a little bit of theory with a little bit of common sense, hopefully it was the right mix.

ReplyDeleteI thought the fixed supply curve discussion was strong. The only point I'd ask you to elaborate on is this: why is the demand curve shaped that way? It's pretty obvious, given a fixed supply, why prices behave that way from the demand curve provided, but not immediately obvious to an outsider why the demand curve is, in this case, that L shape. Ricardo's discussion of relative scarcity seems an appropriate jumping-off point (somewhere in Wisconsin, my former advisor just had a portent of doom as his semester of careful teaching was used to score points in an argument over a children's card game (actually no, he'd probably think that was awesome)).

ReplyDeleteThat's a great question. The reason its shaped like that, is /because/ of the fixed supply curve. As a good becomes scarce, simply raising the SCG buy price by the same increment it was before doesn't entice as many holders of the good to sell as it did before. The last group of people holding on to product, when they know its not readily available to find elsewhere, are unwilling to sell at all. Therefore, stock-outs happen, and the people who /must/ have the cards (see: spikes who must pick up something for an upcoming event) are willing, and will, pay out the ass for them. As of now, SCG has plenty of competitors (and ebayers) offering the same products as SCG, but once it literally becomes next to impossible to find a good for sale, prices skyrocket. (see Candelabra of Tawnos) Candelabra is a great example of this, and Sean even points it out in his article, but then strays from it stating that it is different than what is happening with the rest of legacy staples, when in actuality its not. It's the Exact. Same. Thing. High Tide is the new hotness, and people want it NOW! Well, the amount that exist is extremely limited, and you'll have to pry them from the cold dead hands of certain collectors, and what happens at the top end of this curve, as the exponential approaches vertical, if the demand were to shift far enough to the right, it becomes a true sellers market, where any listed price could be considered fair, because theres such low volume of movement, no fair market price can be determined by data lone. (essentially, all hard/fast rules break down at an infinite slope)

ReplyDeleteThere's more to say about this, but hopefully this at elast partially asnwers your question, gotta run at the moment.

Another thing to note here, it would be even more correct to make a graph like the one shown for each individual card. Some cards are more popular, and are reaching their point of scarcity, while other cards, may have the same amount of cards in print, but be in lower demand. As long as pricing stays beneath the inflection point of the curve, things appear normal, but beyond the inflection point the scarcity takes hold. In theory, we could probably create some sort of average to describe the whole market. But, if one was to do some detailed analysis, it would probably be different charts for different cards.

ReplyDeleteGet me a database! We'll make graphs for each legacy staple!

ReplyDelete